Today, it’s not only the fear about one’s health that keeps people out of the doctor’s office. It’s the real anxiety about medical debt that is keeping people up at night.

For tens of millions of Americans, whose share of the out-of-pocket costs of care continues to rise, medical debt has become an unexpected, unwanted, and financially devastating expense, with 18 to 35% of all Americans having medical debt that is in some form of collections, and accounting

for a full two-thirds of personal bankruptcies (source: www.yourbind.com/ blog/problem-care-avoidance).

Unrelenting medical costs have driven consumers to become increasingly creative, and sometimes risky, in the methods they choose to cover their costs, including dipping into retirement savings, financing medical debt on credit cards and even crowdfunding their medical expenses.

Rather than risk the negative impact medical debt can have on their lives, many Americans avoid seeking care when they need it; cut back on medications to treat chronic conditions like diabetes; or put off important, life-saving screenings like colonoscopies, mammograms, or dermatology exams. According

to the NHIS (National Health Interview Survey), one in 11 adults reported delaying or going without medical care due to cost reasons. Unfortunately, those who are in worse health are most likely to delay or go without care due to cost reasons, compounding the burden once their care becomes emergent. (source: www.healthsystemtracker.org/chart- collection/cost-affect-access-care/)

The irony of avoiding care because of cost is that care avoidance generates more cost. Without preventive

care, the risk of disease increases. Without diagnostic care, diseases

and conditions worsen, which can eliminate treatment options and push patients toward more significant

and costlier care needs. (source: www. yourbind.com/blog/problem-care-avoidance) The most direct impact of this negative cycle is on patients and their health, but there are downstream costs to the entire system.

The ongoing inability to understand the cost of care or manage the financial burden also becomes more than patients can process or afford, compounding issues across the health care system. Providers are spending more on debt collection, only to collect less from patients who struggle to pay. Employers are faced with increasingly unhealthy and absent employee populations, adding cost to their benefits plans when employees end up in the emergency room and leading to increased premiums and higher out- of-pocket costs for everyone.

From the employer perspective, an employee’s physical health, emotional health, and financial wellness are

all becoming more important to the total wellness equation. Four out of five employers say their employees’ personal financial issues are impacting job performance, according to a survey by the International Foundation of Employee Benefit Plans. Financially stressed employees lose nearly one month of productive workdays per year. They also are two times more likely to seek a new job opportunity.

Rather than avoid care, which costs every part of the health care system, people need financial solutions that make paying for the cost of care more manageable and enabling them to access the health care they need when they need it.

A new category of health care innovators is emerging to shift the financial relationship away from providers and debt collection services to “health care payment companies.” They pay the cost of the patient

invoice to the provider upfront and then assume the payment relationship with the patient. As a financial company, they can provide credit

for out-of-pocket costs at low to no interest and construct a payment schedule over time that fits the patient’s needs.

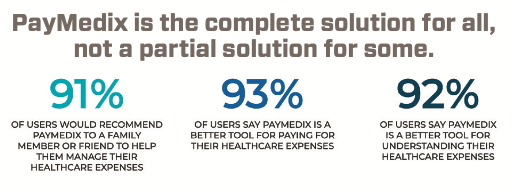

PayMedix is one of the companies reinventing and simplifying the

way health care payments are

made, enhancing patients’ financial wellness so they can prioritize their own physical and emotional health. PayMedix goes beyond just extending credit up to patients’ out-of-pocket maximum with reasonable repayment terms. It guarantees payment to providers and give patients the peace of mind to go and get the care they need. It also gives consumers the information they need to gain control of their medical expenses.

It’s proven that, with planning

and budgeting, most Americans are resourceful and can find effective strategies to manage and pay for

what is most important in their lives. Getting necessary medical care should top the list, along with housing and food. PayMedix takes the guess work out of sorting through the blizzard

of paperwork patients receive by consolidating their portion and paying their contribution upfront. It provides a single, simple statement, so patients

have clarity and know exactly what they owe. This allows them to plan and budget for medical expenses the same way they do for other important living expenses.

The bottom line is that patients and health care providers need a better solution to understand and pay for care so they can access prevention, diagnostic and treatment options sooner. More employers are stepping in to help employees manage the burden of higher out-of-pocket costs by turning to solutions like PayMedix. Every employee can participate in the program regardless of individual credit histories, so there is no fear of being rejected because of credit issues. By paying providers upfront, PayMedix eliminates bad debt, collection costs and ultimately helps alleviate financial stress for patients when it comes to paying for health care.

Company: PayMedix Innovation:

reinventing and simplifying the way health care payments are made

paymedix.com