MILWAUKEE, June 6, 2023 /PRNewswire/ — Unaffordable medical bills, higher deductible health plans, and confusing billing statements have caused an increase in physical and mental health issues for a majority of insured Americans, according to a new study from HPS/PayMedix.

The 2023 PayMedix “Healthcare Payments and Financial Disparities Study” polled more than 1,000 Americans with employer-provided health insurance, along with 210 HR benefits managers, to gain insights into the affordability and impact of the current healthcare billing market.

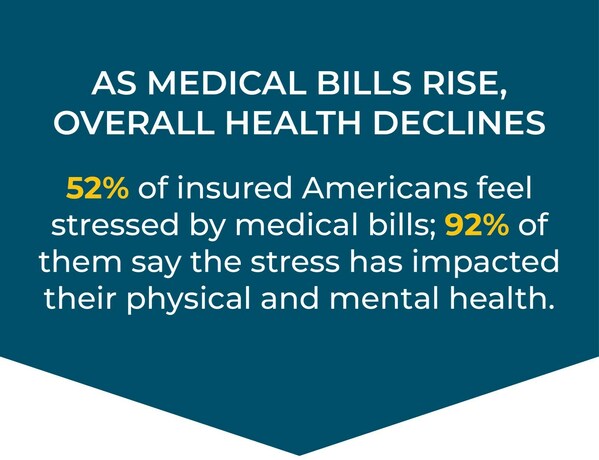

Among the most notable findings are that more than half (52%) of insured Americans said that paying for medical bills has been stressful, with nearly all of them (92%) claiming the stress has affected their physical and mental health.

Health and Financial Wellbeing are Tied Closely Together

The PayMedix study found further evidence that today’s medical billing systems are having an impact on patient wellbeing:

- About one-third of respondents said that out-of-pocket costs (33%) and deductibles (31%) are unaffordable. That increases to four in ten Americans with a credit score of 669 or less who find their deductibles (44%) unaffordable

- Over half of Americans said that in the last six months paying for medical bills has been stressful (52%). The stress is most prominent among younger generations, people of color, and those with a credit score of 669 or lower

- After receiving an unexpected medical bill, consumers may avoid future care altogether, with nearly one quarter (22%) saying it makes them never want to go to the doctor again

- Among a variety of health-related scenarios, nearly a third of respondents said the cost of an unexpected medical bill is the most stressful scenario (29%) that could happen. Only 13% said the same about the cost of having a sick family member

- In the past year, nearly one-in-five (19%) Americans have received collection notices from their medical providers, with a third of millennials (34%) and a quarter of GenZ (27%) getting sent to collections

- Of all those sent to collections, nearly two-thirds (62% ) say they feel more negative about their provider after receiving a collection notice

- This unexpected debt is causing nearly one-third (30%) of Americans to dip into their savings, with nearly one-in-five (17%) having to delay payments. The latter is significantly higher among those with lower credit scores (669 or less), which adds to the never-ending cycle of poor credit

Medical billing stress is compounded by the volume and confusion of billing statements, the PayMedix survey found. Americans report receiving more than 70 bills and statements throughout the past year, mostly in the form of Explanation of Benefits (EOBs), with about a quarter of respondents claiming their EOBs (29%), medical bills (25%), and what they owe (24%) are difficult to understand.

“Affordability challenges are taking a real toll, not only on the financial health of patients but their physical and mental health as well,” said Tom Policelli, CEO, HPS/PayMedix. “It is particularly tough on people with lower credit scores and worsens the gap in health equity. The bad news is that the disjointed nature of our healthcare system has made it hard for consumers to even understand the financial side of their care. The good news is that there are holistic solutions that deliver efficiency to the system and affordability to consumers.”

Employees and Employers Disconnected on Solutions

Now, more than ever, Americans are looking to their employers for help navigating complex healthcare billing systems. A majority (60%) of employees surveyed said their employers should be responsible for providing financial strategies to deal with the confusion, such as simplified billing, flexible payment options, and low-interest credit. Yet, less than one in five report that their employers provide a payment solution that offers credit, or a solution that simplifies the billing experience.

Half of Americans and nearly two-thirds of Gen Z (64%) and Millennials (65%) strongly desire an employer-provided solution for simplified bills. Most are interested in flexible payment options with zero to low-interest credit (72%), as well as providing guaranteed credit up to their OOP maximum (54%).

Yet, while nearly three-quarters of Benefits Managers (72%) said they are likely to consider a simplified billing experience that offers financial security for all employees, fewer than 4 in 10 claim they currently have solutions in place. This also conflicts with what consumers report when asked if their employer offers any kind of support.

“Many consumers feel like they have high deductibles even if their plan does not fit the government’s legal definition of one. As companies push more of their workforce into high-deductible health plans, employees feel their employers have a responsibility to do more to help with the volume, confusion, and stress of healthcare billing,” said Brian Marsella, President, HPS/PayMedix. “If benefits managers knew how much stress medical billing was causing their employees and the toll it is taking on their physical and mental health, they would act to enhance their wellness programs to include financial strategies to help reduce the burden of paying for healthcare.”

About PayMedix

PayMedix, which began as the financing arm of Wisconsin-based HPS over a decade ago, is the only company solving the problem of high out-of-pocket costs for everyone: providers, patients, employers and TPAs. By guaranteeing payments to providers and credit for all patients, PayMedix is changing the way people access, use, and pay for healthcare. PayMedix has processed more than $5 billion in medical payments for hospital systems and physician practices and can be implemented in conjunction with any PPO or HMO network.

About HPS

Health Payment Systems (HPS) is a privately held healthcare technology and services organization with solutions that reduce the cost and complexity of the healthcare payments process to benefit providers, employers, patients and TPAs. Headquartered in Milwaukee, Wisconsin, HPS has an independent network of 96 hospital facilities and 27,000 individual providers.